Challenges like these simply can’t be overcome without effective, efficient corporate management and an adaptable corporate organization. A risk management system that includes internal monitoring, effective controlling for subsidiaries, and a far-sighted early warning capability is essential. It not only makes sure that you stay within the law, but also helps safeguard the future and build the company’s lasting value.

Any entrepreneur knows risk is inevitable, and that its effects are hard to predict. Here a systematic process helps recognize and assess risks promptly. We can help you introduce this kind of risk management system at every stage, whether in conception, in guiding the project, or in the skills and content needed to put the system into operation. You also benefit from our years of experience with many different sizes of companies from a wide range of industries when it comes to choosing a computerized risk management system.

We’ll be happy to assess the risk management system already in place to see how it might be refined further. We pay special attention to whether the system completely covers your company’s risk situation, and whether the early warning mechanisms are workable in practice.

Ebner Stolz’s experienced practitioners offer you a skilled team of advisors in every discipline, who always have current developments on their radar and never lose sight of meeting compliance requirements as part of a highly practical risk management system.

Our services at a glance

- Implementation of Risk Management Systems

- Quick-Check Risk Management

- Evaluation of an Existing Risk Management System

- Expanding into a Full-Fledged Compliance Management System

- Special Issue: Risk Management for Financial Services Providers

Implementation of Risk Management Systems

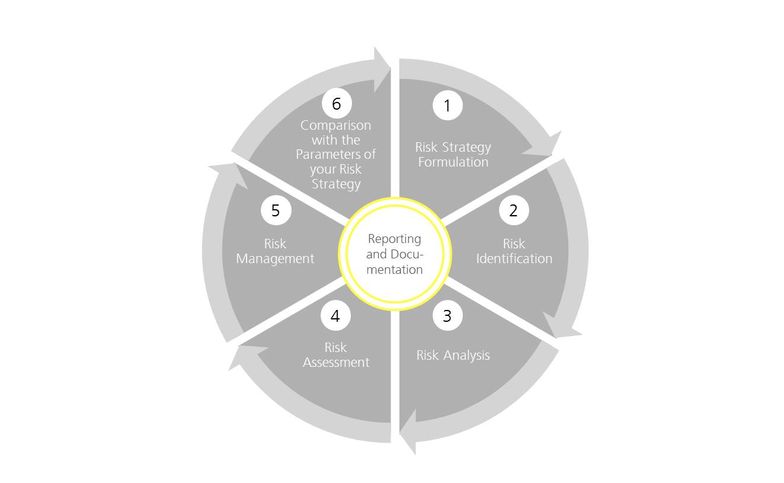

- Risk Strategy Formulation

We will help you determine how high your company’s risk-bearing capacity is. In this connection, there are special corporate structuring challenges that we will help you meet. We will work with you to develop general principles for handling risks depending on your company’s risk appetite. - Risk Identification

We will work closely with your Risk Manager to conduct a risk inventory. Our broad experience in working with other companies helps us ask the right questions. Alternatively we can design a risk inventory for you which you can then conduct yourself. Naturally we can also recommend the best software for this task. - Risk Analysis

We will analyze the risks and relate them to one another. Many risks cancel each other out, while others intensify each other. The risks must also be evaluated from the perspective of a group of companies, since risks at the level of subsidiaries have a different relevance for the group as a whole than for the subsidiary itself. - Risk Assessment

We will work with your Risk Manager to assess the risks, using software such as Excel, so that we can provide you with a customized Excel tool. The assessment will be carried out on the basis of a risk matrix that we have defined with you in advance. - Risk Management

If you wish to go beyond a mere early-warning system, we can use state-of-the-art measures to manage risks. To do so, we must determine how to test the effectiveness of these measures. As we provide our consulting services, we often discover risks for which there are not yet any risk management measures or the ones in place are insufficient. We will develop new risk management measures and can work with you to develop a plan for implementing them. The byproduct of many consulting projects is a better permeation of your processes, thus improving them and making them more secure. - Comparison with the Parameters of your Risk Strategy

We recommend regularly comparing your risk management system and the defined parameters with the actual conditions (is the system being carried out?) and the company’s goals/strategies, which may have changed (is it still the right system for us?). Changes in market demands can require changes in risk reporting, as new fields of risk must be defined, or your risk inventories may be conducted too often (or not often enough) and have to be adjusted.

Quick-Check Risk Management

Would you like to know right away whether your current system is up to date? Whether your system meets the requirements of the IDW PS PS 981 standard? Or whether there are individual aspects of your system that can be improved?

It will take one of our experienced specialists at most a half day to evaluate your system (depending on its complexity) and provide you with concrete suggestions for improving it. You can then implement these suggestions yourself. Naturally we can also assist you, if you so desire.

Evaluation of an Existing Risk Management System

Our services range from evaluating compliance with the basic standards, to auditing of systems when such audits are required (such as for listed companies) or conducting voluntary audits (such as at the request of a supervisory board or using the questionnaire under the Law on Basic Budgetary Rules). We will agree with you on the scope of the assignment.

In practice, risk management systems are often tested by Internal Audit. In smaller companies, and even at mid-sized ones, there is often no provision for a systematic review. And at those companies, it is a good idea to perform such a review from time to time. This allows you to make sure that your current system is not merely a paper tiger and that the procedures you came up with are actually being implemented.

In connection with our audit, we will obviously not just point out weaknesses but will also suggest possible solutions. You will benefit from our wide range of experience, our interdisciplinary approach and our knowledge of how to implement such systems.

Expanding into a Full-Fledged Compliance Management System

Perhaps you have a risk management system and are wondering whether it could be the basis for a compliance management system or whether you would have to start over when you tackle compliance?

We can help you figure that out. We will analyze your current system, discuss your ideal compliance management system with you and show you how to get there. If you so desire, we can get your risk management system into shape so that it will be ready to handle compliance risks in the future.

Special Issue: Risk Management for Financial Services Providers

Financial institutions and financial services providers are subject to special risk management requirements.

We offer up-to-date information on the BaFin’s minimum risk management requirements.

We will also be glad to assist with issues involving your risk management system. This includes auditing your risk management processes and showing you whether your system meets the BaFin’s requirements. At the same time, we will identify any weaknesses in your system. Our suggestions for improvement will help you enhance the quality of your risks management system. If you use IT applications, we can also evaluate your interfaces. This will ensure that your data can be used properly for risk management purposes.