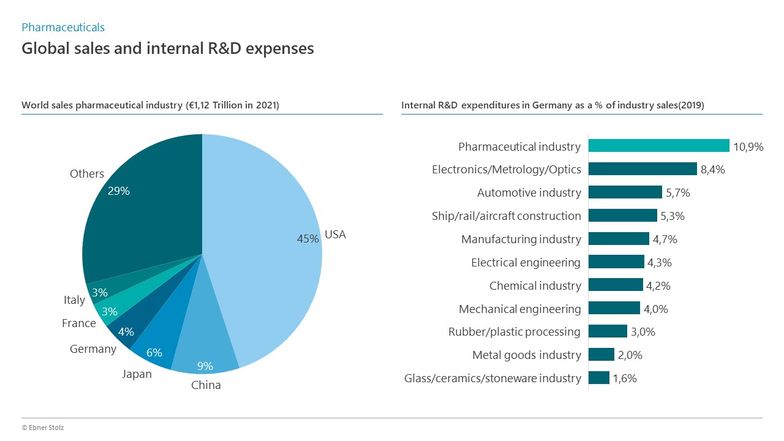

Considering these challenges, pharmaceutical and medical technology companies are operating dynamically in an extremely competitive environment characterized by ongoing cost pressure, steadily increasing regulation, and volatile supply chains. On average, German pharmaceutical companies invest more than 10% of their annual sales in in-house research and development - more than any other industry sector.

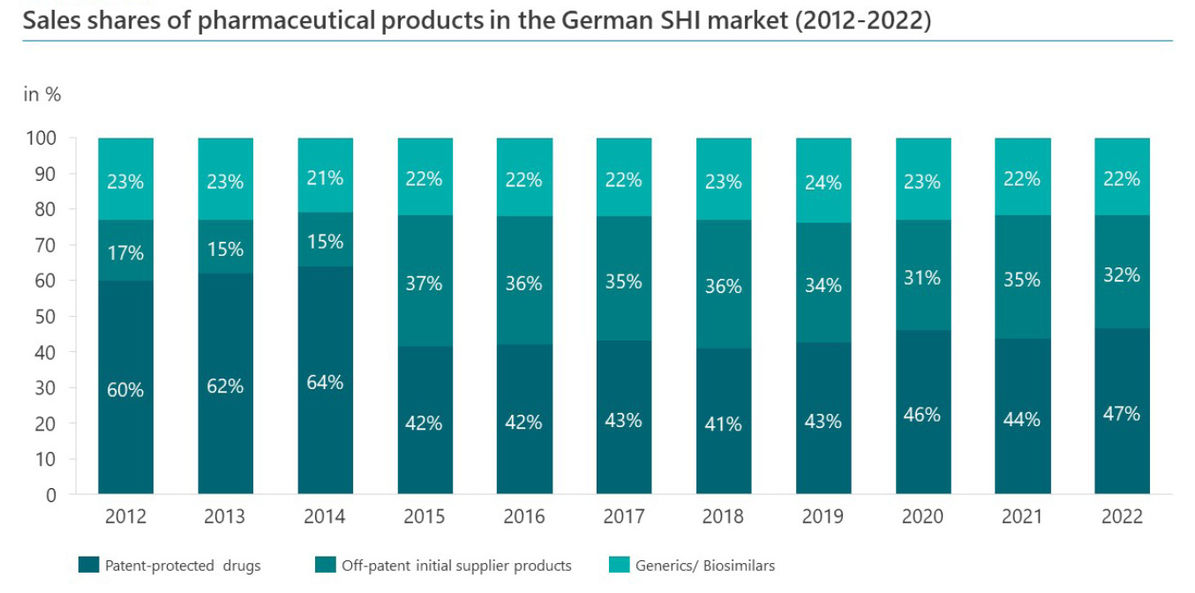

Of the nearly 700 German companies falling under the pharmaceutical sector, more than 90% are SMEs and MidCaps. With sales of EUR 49 billion in 2021, the German pharmaceutical market ranks fourth worldwide, behind the USA, China, and Japan, and has also established itself as the largest pharmaceutical market in Europe. Its importance lies particularly in its strong roots in small and medium-sized enterprises. Within Germany, around half of SHI market sales in 2022 will be accounted for by patent-protected drugs, followed by off-patent initial supplier products with 32% and finally generics / biosimilars with 22%. It should be emphasized that the share of drugs approved in Germany is roughly the same for prescription and over-the-counter drugs.

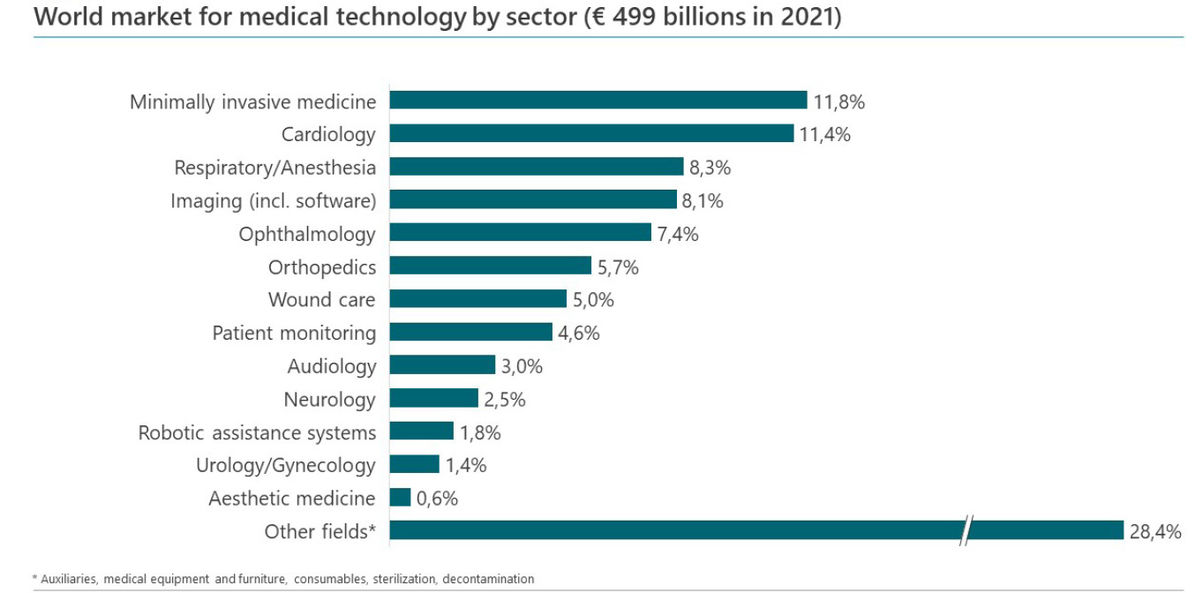

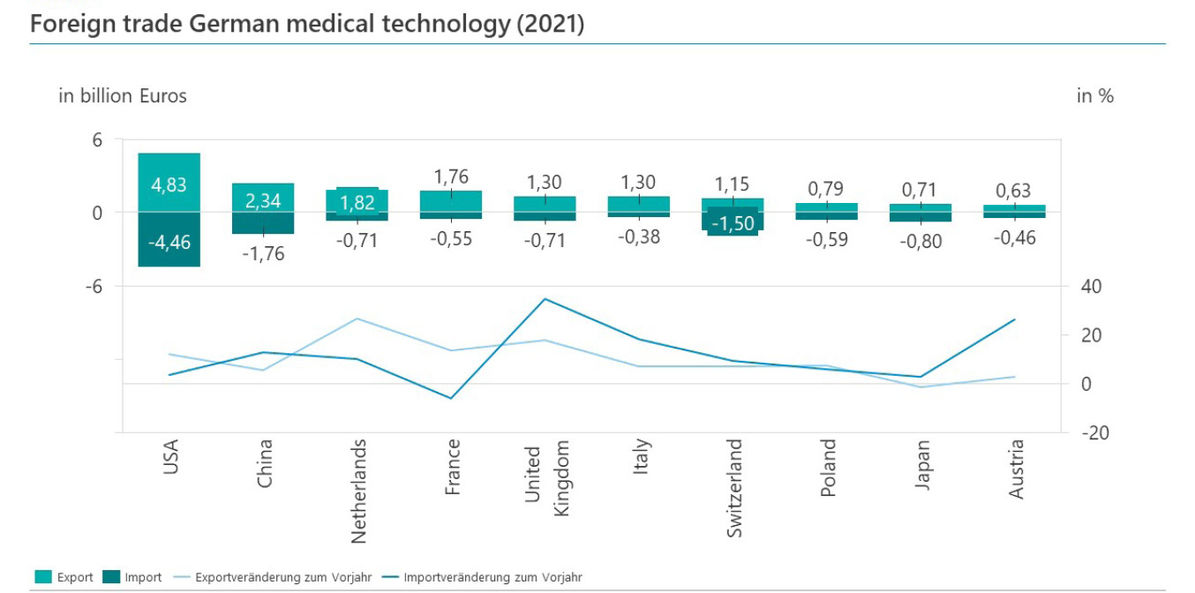

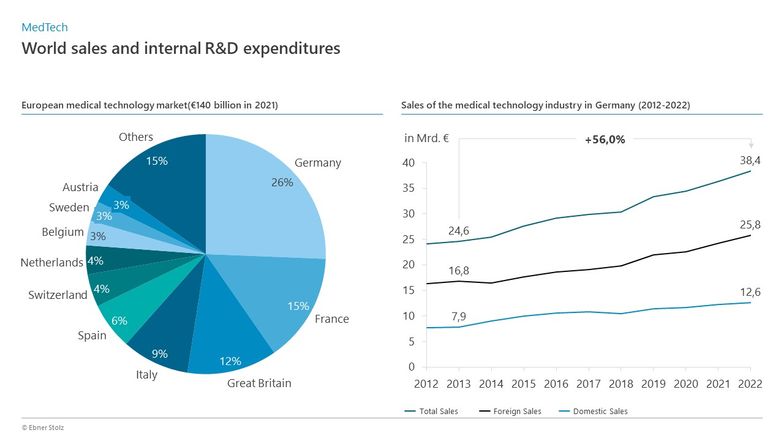

The medical technology sector in Germany is also dominated by medium-sized companies. 93% of the nearly 1,500 medtech companies employ up to 250 people. In addition, Germany also plays a leading role here at international level. In 2021, the European medtech sector generated value added of more than 140 billion euros, of which Germany holds the leading position with a market share of more than 26%. In comparison, Europe's second largest market player, France, accounted for only 15% of sales. The impressive export ratio of 67% in 2022 further underscores the international competitiveness and innovative strength of the German medical technology sector.

As a strategic partner with a clear focus and many years of experience in these industry segments, we are familiar with the complexity of the industry and its various stakeholders, understand the regulatory requirements as well as the international character and are very aware of the high innovative strength of the companies in these markets. We go beyond pure consulting and are at your side to further develop your company and business model, to secure sustainable competitive advantages in the future or to work out succession solutions. Benefit from our business and financial, tax or legal expertise as well as our extensive consulting and transaction experience in these industries. Our dedicated team works hand in hand to develop customized solutions for you that are not only convincing on paper but can also be successfully implemented in practical day-to-day business.

You can rely on our interdisciplinary cooperation, in which our auditors, tax consultants, lawyers and management consultants work closely together to ensure that your concerns are in the best hands.