RSMinvoice Testkit: Everything ready for E-Invoicing?

With our RSMinvoice Testkit, you gain clarity: Is your e-invoicing solution performing reliably in practice? Check whether incoming e-invoices are correctly validated and your processes function seamlessly.

Why this is important: Since 1 January 2025, companies must be able to receive e-invoices. However, merely implementing an e-invoicing solution is not enough: Without thorough validation, there is a risk that non-compliant invoices may be processed, potentially leading to the loss of input VAT deduction or delays.

The RSMinvoice Testkit powered by greenfield addresses this exact issue: It specifically tests the resilience of your e-invoicing solution. Find out whether non-compliant invoices are detected correct and whether your processes are adequately safeguarded.

- Maximum security for your digital invoice receipt: Detect faulty invoices at an early stage.

- Ensure compatibility: Guarantee that your solution meets current legal requirements and technical standards.

- Simple and practice-oriented: Our test kit is user-friendly and precisely tailored to e-invoicing solutions in ERP systems.

- Time savings: Reduce administrative efforts by ensuring accurate validation early on.

Readiness to receive e-invoices as of 1 January 2025

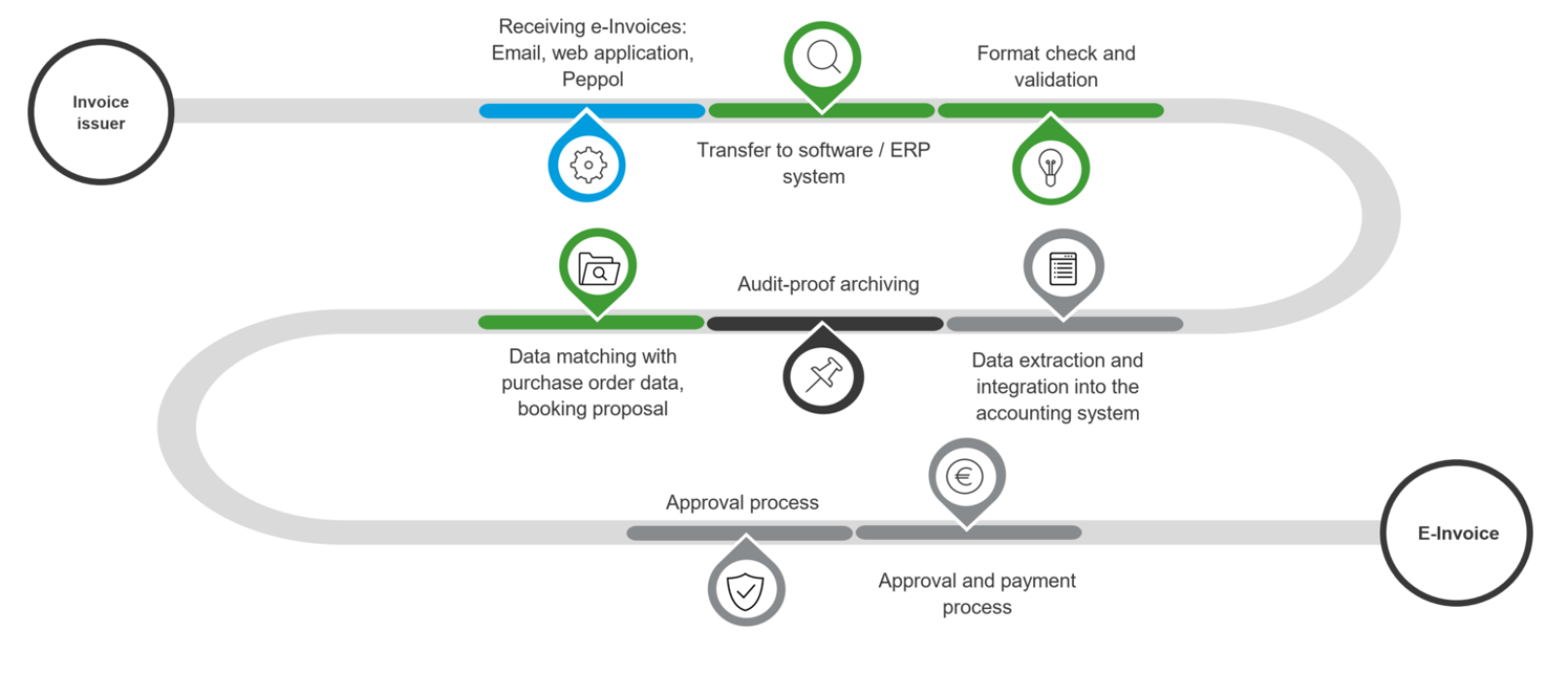

The requirement to be able to receive e-invoices as of 1 January 2025 can already be fulfilled by maintaining an email inbox to which e-invoices are sent. However, to ensure input VAT deduction, readiness to receive involves significantly more:

- The formal and material prerequisites for input VAT deduction must be verifiable for each invoice, including every e-invoice. If the invoice is not transmitted in a so-called hybrid format (containing both a structured data format compliant with CEN Standard 16931 and a human-readable version), then at minimum an e-invoice viewer is necessary.

- Since the data structure can be fulfilled by different e-invoice formats, it must be checked whether various reception channels are necessary to ensure the correct processing of invoice information.

- Additionally, it must be ensured that documentation and record-keeping obligations are met. This includes:

- Ensuring the authenticity and integrity of invoice data

- Immutability of data

- Timely recording and document security

- Indexing and traceability of invoice receipt.

Performance of your e-invoicing software

Even if your ERP system includes or has been supplemented with e-invoicing functionality, the question remains: Can your system identify faulty e-invoices and highlight issues clearly? Your e-invoicing solution should meet the following core requirements:

- Validation of the accuracy of incoming e-invoices, including:

- Compliance with the CEN Standard EN 16931 data structure

- Correct completion of all data fields (or business terms)

- Clear and understandable error messages

- Verification of all invoice characteristics according to Sec. 14 of the German Value Added Tax Act, particularly confirming the adequacy of the service description

- Verification of agreed business rules (e.g. VAT breakdown, payment terms, discounts).

- The e-invoicing solution must ensure seamless integration of the e-invoicing workflow into existing ERP processes.

- Ideally, the e-invoicing software should also support comprehensive invoice management, including automation of accounts payable.

- To ensure compliance with all legal requirements, the legal, content-related and technical responsibilities between your company and the software provider must be clarified.

A functioning e-invoicing solution as a competitive advantage

The introduction of e-invoicing provides with a major opportunity to digitise internal processes without media discontinuities and to drive automation forward.

From a business perspective, the processing of digital data should be understood as an opportunity to increase the degree of automation and as a catalyst for growth.

In the future, only those who fully and promptly implement e-invoicing will be able to maintain business relationships with customers and suppliers – they must comply with the new requirements in the same manner and will seek to optimise their own processes accordingly.

Finally, e-invoicing is the first important step towards ViDA readiness. The EU requirements surrounding e-invoicing lay the foundation for a unified, EU-wide reporting system set to come into effect from 2030. Companies should therefore ensure their system landscape is technologically open and adaptable to future developments – securing the long-term viability of their invoicing processes.

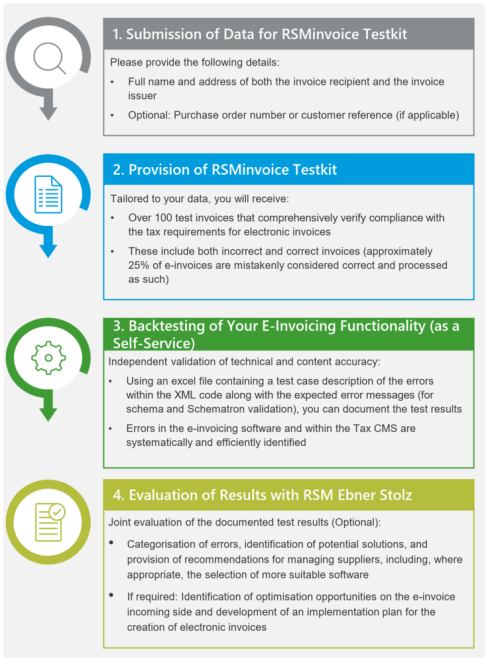

E-invoicing stress test: The RSMinvoice Testkit

Check whether your e-invoicing solution delivers on its promises, thoroughly examines all incoming e-invoices for potential errors, and reliably displays them. With our RSMinvoice Testkit, you receive a well-founded assessment and clarity about whether your company is ready for receiving and processing e-invoices.

We only need a few basic details from you. You will then receive our test invoices along with an Excel-based evaluation matrix, enabling you to carry out the test quickly and easily. If needed, we will be happy to evaluate the test results with you and develop pragmatic, tailored solutions.

RSMinvoice Testkit is powered by greenfield Steuerberatungsgesellschaft mbH, our cooperation partner.

Contact Person

We are happy to answer your questions about our RSMinvoice Testkit. Take advantage of the time lead you gain by implementing a tested e-invoicing solution.

Contact