The German M&A market at a glance: Current trends, challenges & drivers

The German market for mergers and acquisitions (M&A) is a key factor for entrepreneurial growth and transformation. However, economic and (geo)political uncertainties and the resulting volatile conditions have had a noticeable impact on the M&A market in recent years. Which trends will dominate the market in 2025 and which drivers will characterise future transaction activity? A look at current developments and challenges provides valuable insights.

Macroeconomic challenges

The economic situation in Germany proves to be challenging for M&A transactions. While many regions around the world are experiencing moderate economic growth, Germany is in recession. Official forecasts for the current year continue to range between slightly negative growth of -0.2 % (e.g. DIW Berlin) and an increase in gross domestic product (GDP) of 0.4 % (OECD). There are therefore currently no signs of an economic upturn in sight.

Interest rate developments in recent years have also made the framework conditions for M&A activities more difficult: after a phase of zero interest rate policy (2016 to 2021), the European Central Bank (ECB) has successively raised key interest rates sharply since mid-2022, up to 4.5 %. For the M&A market, this means that transactions will once again entail real financing costs. Although the ECB initiated a turnaround in mid-2024 and key interest rates have been falling steadily since then (key interest rate as at 04/25: 2.25 %), the lending volume has hardly changed in the last two years and access to fresh capital remains challenging, especially for SMEs.

In addition, the inflation trend, which peaked at 8.8 % in mid-2022, had a noticeable impact on the M&A landscape. Energy prices in particular rose rapidly by up to 36 % from 2021 onwards, which put enormous pressure on competition, especially for energy-intensive companies in Germany. Although the situation has recently eased somewhat, energy costs in Germany are still about 20% above the European average and, compared to the Nordics, in some cases more than 60% higher.

In summary, the volatile M&A market environment is characterised by many economic and (geo)political uncertainties, which, according to a flash survey conducted during our webinar on 29 April 2025, are among the biggest challenges in the transaction business. Uncertain market conditions can in turn lead to M&A transactions being approached with a certain degree of caution or not being carried out at all, although the impact of these factors can vary depending on the sector.

In addition, many other factors such as business expectations, commodity and producer price effects, etc. have an impact on the M&A market environment.

The current transaction environment

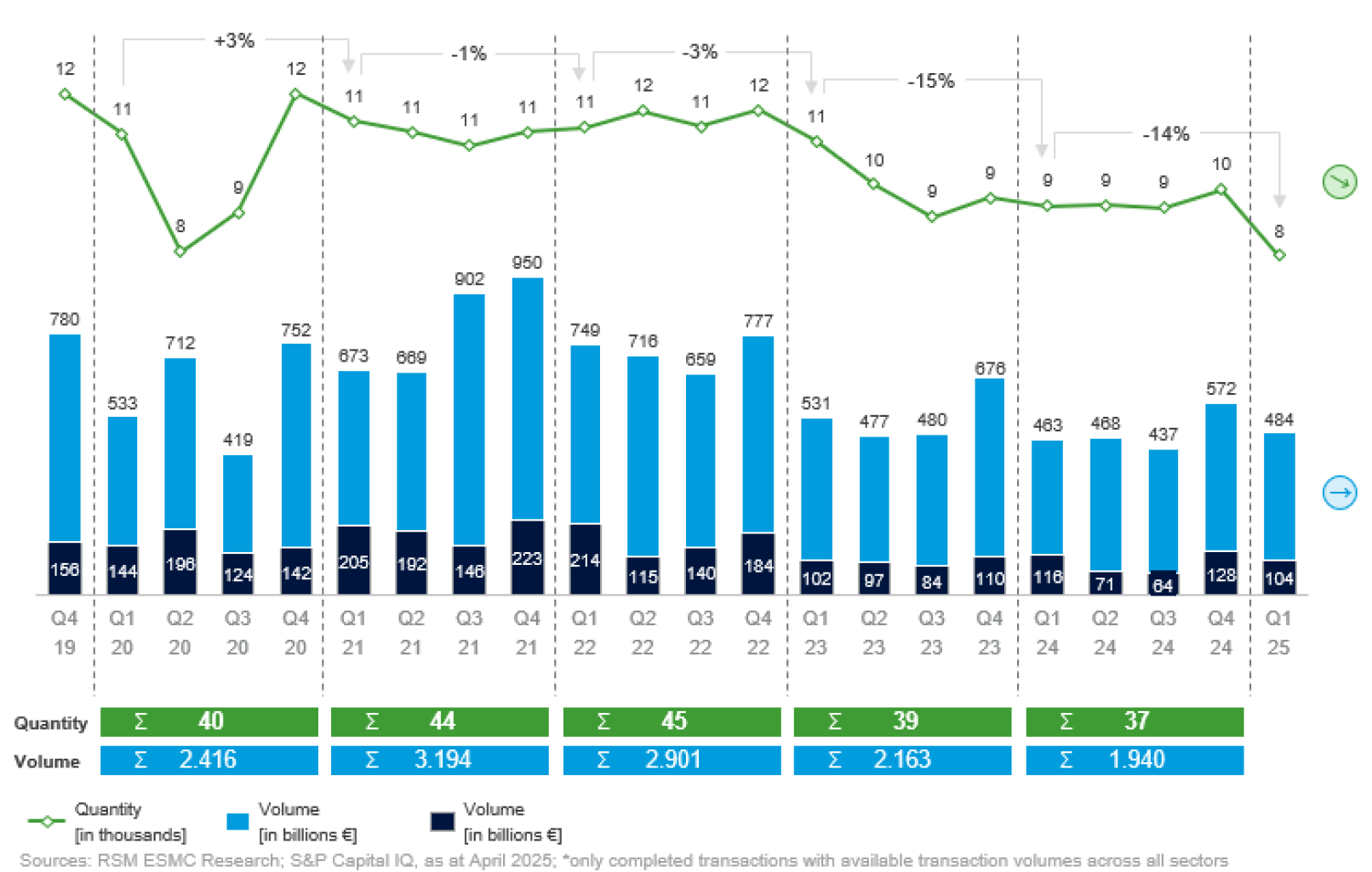

How do the macroeconomic conditions described above affect the M&A context? After the pandemic-related slump in 2020, the M&A market experienced a brief boom in the following two years. Since the end of 2022, however, the number of M&A transactions has been declining with a certain "bottoming out" since the second half of 2023 with largely stable transaction volumes. However, a further decline in transaction activity was recorded in the 1st quarter of 2025. While few transactions are currently taking place in the large cap segment, the number of transactions in the small cap and mid cap segments remains relatively stable.

Number & volume of M&A transactions, global and Europe*

Current drivers of transaction activity

Despite the sometimes difficult framework conditions, various influencing factors can be identified that are likely to help shape the dynamics of the M&A market in the current year and beyond and create new prospects.

Consolidation trends and increasing pressure to transform are important drivers of takeovers and mergers. This applies in particular to sectors in which companies are forced to realign their positions and drive innovation due to disruptive economic and regulatory developments (such as the automotive industry).

Another important driver is the M&A backlog, which has arisen due to postponed succession solutions and private equity exits, for example. With regard to company succession, the German SME sector is facing a wave: around 190,000 successions are due by 2026 - a figure that will increase to over 500,000 in the medium term due to demographic change. This makes succession issues a key market driver. Private equity investors are under pressure to realise the required exits and returns due to the already extended holding periods - another key driver for the M&A market.

In addition, carve-outs, i.e. spin-offs and sales of parts of companies, are becoming increasingly important on the market. As a strategic means of transformation, they are high on the agenda of corporates - especially larger medium-sized companies. Portfolios are increasingly being reviewed, new strategic priorities are being set and carve-outs are being prepared or implemented accordingly. According to reports, around 80 % of market players assume that carve-out activities will increase in the next 12 to 36 months and are therefore another important driver.

The number of distressed deals has also increased significantly in recent months. The number of corporate insolvencies has risen by 56 % since 2021, with major insolvencies even increasing by a remarkable 117 %. The developments that jeopardised the company's existence during the coronavirus pandemic were postponed by government support and are now gradually having an impact. This catch-up effect is likely to keep the market moving.

Conclusion

The macroeconomic conditions in Germany remain challenging for the M&A sector, particularly in view of the weakening economy. However, there are initial signs of recovery: the inflation rate has fallen and the ECB's continuous reduction of the key interest rate to the current 2.25 % is another positive signal. In addition, the German M&A market has so far proven to be resilient and adaptable despite all the uncertainties. In particular, it should be emphasised that the number of transactions in the small cap and mid cap segment has remained relatively stable, although the number of transactions has declined overall. This illustrates that the German SME sector is and remains a key factor for the M&A market, be it in the context of company successions, (international) growth strategies or strategic carve-outs. However, a decisive factor for a sustainable revival of the M&A market is the stabilisation of macroeconomic conditions and the absence of uncertainties. Such stabilisation creates predictability and thus increases the willingness to invest, which is essential for M&A transactions.

Contact